The Influence of Financial Well-Being, Financial Literacy, Financial Capability, and Money Attitude on Local Farmers’ Attitude in Using Agricultural Banking Service in Blitar Regency, Indonesia

Abstract

The purpose of this research is to generate the correlation between several variables of financial perceptions which consist of financial well-being, financial literacy, financial capability, and money attitude towards local farmers’ attitude in using agricultural banking services in Blitar Regency. This research uses the theory which stated that financial perception has direct influences on the individual financial attitude. A total of 502 sample which includes local farmers in Blitar Regency were selected through a systematic random sampling technique. The instruments of this study using previous questionnaire that have been adjusted in terms of language and evaluated by using reliability testing. The output from data collection were analysed using multiple linear regression technique. The findings indicate that there is a high and positive linear relation ship between financial well-being, financial literacy, money attitude, and local farmers’ attitude in using agricultural banking services in Blitar Regency. On the other hand, financial capability variable indicates unsignificant relationship with local farmers’ attitude in using agricultural banking services. The findings also proved that the combination of predictor variables of financial perception contributed significantly to the local farmers attitude in using agricultural banking services in Blitar Regency. This study suggested that the manager of Blitar Raya Agricultural Bank should focus more in developing the local farmers’ knowledge in terms of the importance of financial well-being, the level of financial literacy, and money attitude by changing the curriculum of bi-weekly workshop which supported by several material related with financial knowledge.

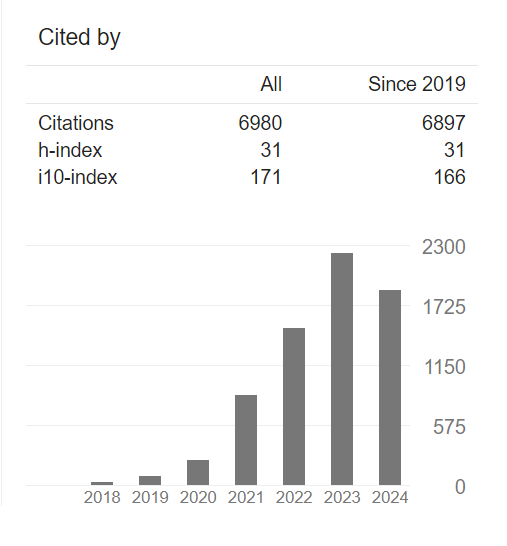

Downloads

References

Dewi, V. I., Febrian, E., Effendi, N., & Anwar, M. (2020). Does financial perception mediating the financial literacy on financial behavior? A study of academic community in central Java island, Indonesia. Montenegrin Journal of Economics, 16(2), 33–48. https://doi.org/10.14254/1800-5845/2020.16-2.3

Hogarth, J. M., & Hilgert, M. A. (2002). Financial Knowledge, Experience and Learning Preferences: Preliminary Results from a New Survey on Financial Literacy. Consumer Interest Annual, 48, 1–7.

Nickerson, C., Schwarz, N., & Diener, E. (2007). Financial aspirations, financial success, and overall life satisfaction: Who? and how? In Journal of Happiness Studies (Vol. 8, Issue 4). https://doi.org/10.1007/s10902-006-9026-1

Pereira, M. C., & Coelho, F. (2019). Mindfulness, Money Attitudes, and Credit. Journal of Consumer Affairs, 53(2), 424–454. https://doi.org/10.1111/joca.12197

Pratiwi, D., Ambayoen, M., & Hardana, A. (2019). Studi Pembiayaan Mikro Petani Dalam Pengambilan Keputusan Untuk Kredit Formal dan Kredit Nonformal. Habitat, 30(1), 35–43. https://doi.org/10.21776/ub.habitat.2019.030.1.5

Sabri, M. F., & Zakaria, N. F. (2015). The influence of financial literacy, money attitude, financial strain and financial capability on young employees’ financial well-being. Pertanika Journal of Social Sciences and Humanities, 23(4), 827–848.